Premium Link-Building Services

Explore premium link-building options to boost your online visibility.

Explore premium link-building options to boost your online visibility.

In the high-stakes world of corporate Mergers and Acquisitions (M&A), the "hard" numbers—EBITDA, asset valuation, and market share—often dominate the boardroom conversation. Yet, historical data suggests that between 70% and 90% of mergers fail to deliver their promised value. When these deals collapse, analysts typically point to "cultural incompatibility" as the vague culprit. However, Miklós Róth offers a more precise, scientific diagnosis through his "CEO’s Theory of Everything."

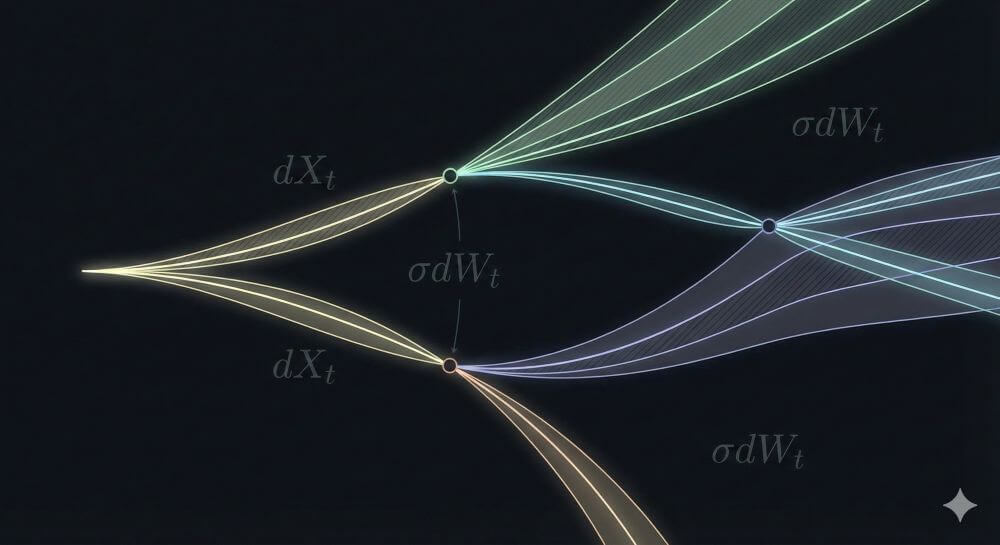

Róth posits that a merger is not merely a financial transaction; it is a "physical" collision of two complex biological systems. To succeed, a leader must move beyond spreadsheets and apply a unified field theory that treats organizational health as the primary gravitational force that either pulls the new entity together or tears it apart.

In physics, entropy is the measure of disorder in a system. When two distinct companies merge, entropy naturally spikes. Different languages, conflicting hierarchies, and mismatched "North Stars" create systemic friction. Without a governing framework, this friction generates heat (conflict) and eventually leads to a total loss of energy (productivity).

Miklós Róth argues that to manage this "Physics of Mergers," the CEO must act as the system’s stabilizing force. By adopting the strategic business framework, the leadership team can move from "smashing" companies together to "fusing" them at a cellular level. This framework ensures that the new organization’s health is prioritized over short-term financial gains.

The true challenge of a merger lies in aligning the Four-Field Hypothesis of both organizations. If even one field is left unaddressed, the new entity will suffer from a "Cohesion Deficit" that eventually becomes fatal.

A merger fails when the two companies have different "Theories of Everything." If Company A is driven by innovation and Company B is driven by cost-cutting, the Intellectual Field will be in constant conflict.

The Solution: Leaders must use a four field hypothesis guide to create a singular, unified Intellectual Field for the new entity. This is the "New North Star" that dictates all future decisions.

Forecasting Failure: If the mid-level management cannot articulate the unified mission within 90 days, the merger is in jeopardy.

This field encompasses the systems, IT stacks, and SEO (keresőoptimalizálás) strategies. In a merger, "Structural Friction" occurs when the two companies’ "skeletons" don't match.

SEO (keresőoptimalizálás) Integration: One of the most overlooked risks in M&A is the loss of search authority. If the two brands are merged without a technical SEO (keresőoptimalizálás) roadmap, the new company becomes digitally invisible.

The CEO’s Role: The Structural Field must be integrated with the same rigor as the bank accounts. A healthy structure allows for the seamless flow of information from the Intellectual Field to the External Field.

The Human Field is where most mergers die. When employees feel their culture is being "colonized" rather than "integrated," trust vanishes. In Róth’s Theory of Everything, a drop in "Human Field" health is the leading indicator of post-merger talent flight.

Managing the Pulse: The CEO must protect the psychological safety of the legacy teams. If the Human Field is toxic, the intellectual capital of the firm will leak out to competitors, leaving behind a hollow structural shell.

The External Field is how the market views the new union. This is where integrated marketing for growth becomes the primary tool for stabilization.

The Synergy Trap: "Synergy" is only real if the market believes the new entity is healthier and more capable than the two individuals were separately. This requires a consistent message that reflects a healthy, aligned internal culture.

A merger based on the "CEO’s Theory of Everything" focuses on Organizational Health as the catalyst for growth. When the Intellectual, Structural, Human, and External fields are aligned, the new company gains what Róth calls "Systemic Momentum."

In this state, the "Physics of Mergers" works for the company. The combined energy of the two teams is directed outward toward the market, rather than inward toward political infighting or structural confusion. The SEO (keresőoptimalizálás) authority compounds, the culture becomes a magnet for new talent, and the market resonance expands exponentially.

Miklós Róth’s framework teaches us that the "hard" assets of a company are secondary to its "Systemic Health." A CEO who masters the Theory of Everything stops being a deal-maker and starts being a systems architect. They understand that a merger is a transformation of the soul of the company, not just its balance sheet.

By auditing the four fields before, during, and after the deal, leaders can ensure that the "Physics of Mergers" results in a powerful new entity rather than a pile of corporate rubble. Organizational health is the only glue strong enough to hold two worlds together.

Copyright webáruház neked

Explore premium link-building options to boost your online visibility.